As I write this article, cryptocurrency is seeing a large shift down on its value. Accept crypto as payment is a risk, and I advise anyone to do extra research to see if it will work for them when asking Should my business accept cryptocurrency as payment.

Key Takeaways

- Using a payment processor we accept cryptocurrency while receiving ‘normal money’

- There are great services making it easy to accept

- Most countries have simple tax rules

What is cryptocurrency?

Cryptocurrency is a digital form of money without banks or centralised control. Miners use computers to power payments, while everyday users pay a tiny percentage for the privilege.

We didn’t want to spend too much time explaining crypto. We wanted to discuss its business use. Here is a great article that explains the very basics. Give it a read if you don’t know and don’t forget to pop back and continue reading Should I accept Bitcoin as payment.

Pros of accepting cryptocurrency

How many crypto millionaires are there?

Our first reason why we might accept this digital payment is a huge amount of crypto millionaires. 81,000 Bitcoin wallets have $1 million plus. 300+ million people own a cryptocurrency, 100 million of these are in India.

If you sell high-end products or services, this may be a market you want to tap into. By accepting crypto as a payment method, we might become their preferred supplier instead of our competition.

| Crypto Currency | Number of Millionaires |

| Bitcoin | 81,000 |

| Ethereum | 6000 |

| Shiba Inu | 1000+ |

| Doge | 2866 |

International markets

Crypto doesn’t have borders, retailers can sell to international markets without accepting 20 different currencies or bank transaction charges that accompany them.

Lower transaction fees

Credit card processing costs 20p per transaction plus 1.4% of the total transaction. Crypto on average costs less than 20p, though this can fluctuate, bitcoin is normally less than 1% of the transaction total.

A £1000 transaction will cost £14.20 on a credit card vs £7 for Bitcoin

Protection against charge-backs

In the UK chargebacks are not something that happens regularly, in the USA it can be a problem for many small businesses. Crypto payments can’t be reversed by anyone so should my business accept cryptocurrency?

Simple tax for crypto currency

Many countries, including the UK, have legislation regarding cryptocurrency. The UK, state’s cryptocurrency is income. We pay taxes inline with current rules. This makes accepting crypto a little easier and less complicated.

Should my business accept cryptocurrency – CONS

Value fluctuations

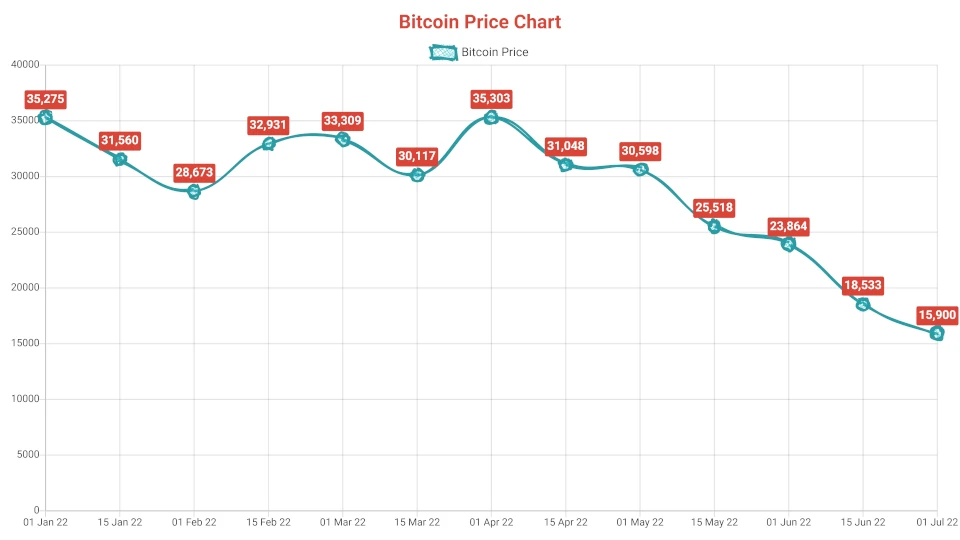

Its value heavily fluctuates. Since January 2022 bitcoin has halved in value. That’s unheard of in any other market. By accepting crypto, we could lose value the instant it hits our wallet.

Suppliers

Our suppliers don’t accept it. No matter what we do or how we allow clients to pay. If our suppliers don’t accept it as payment. We will need to front the cost ourselves or sell coins we need for the job.

Tax & Legislation

Though many governments quickly made tax easy, legislation could change

it would also affect its price and send signals to other governments who may follow suit.

If you accept it as payment, expect rules, laws, and taxes to change eventually.

Technical know-how needed to accept crypto

Its easy, we need to set up a wallet, an exchange account and learn the basics of how to send and receive coins. It’s easy in the long run with a small learning curve.

If I.T. Recipes receive enough requests, we will create a small how to series on small business crypto.

Technical know-how also extends to employees, they may have to take payments or explain to clients that the option is available. There’s also the possibility employees want to be paid in crypto.

The technical know-how needed is similar to learning how to use a new POS system or changing bank.

What happens after we accept crypto as payment?

- We don’t have to keep it, as soon as it hits our wallet we could transfer it to an exchange and sell, sell, sell. Once sold, you’re back to having ‘normal’ money.

- HODL, we can also hold our bitcoin in hopes its value will skyrocket again, become bitcoin millionaires and retire on a beach.

- Spend our cypto with suppliers that accept it

Which cryptocurrency should I accept?

Most people have heard of Bitcoin, some may have heard of Ethereum, Shiba Inu, Doge and BAT. There are hundreds of different coins, they are not all created equal.

Whatever you decide at the end of this DON’T accept them all, it’s like accepting pound sterling, euros, Cuban peso, Sri Lankan rupee and US dollars. It will be difficult to manage, convert them into something you can use, and require multiple accounts.

Bitcoin is the obvious choice because of its popularity, but Ethereum is up there too with a round 6000 millionaires, Shiba Inu has 1000+ millionaires, and Doge has 2866.

How to accept cryptocurrency

If we decide to accept crypto as payment, we will need to decide how we will go about it

There are a few options for cryptocurrency payments

Manual

I would avoid this one if you’re still on the fence or don’t feel you have the technical know how. We will need to set up a wallet and an exchange account if you plan to exchange for hard cash. Then publish our address and / or QR code on our website. There’s no real integration with your online shop with this method. It is best for donations / buy me a coffee type setups.

A manual approach is like accepting bank transfers, we need to receive an order then monitor our crypto wallet to know payment is received.

Payment processor (recommended)

There are a few payment processors available, some bigger names include Coinpayments, Bitpay, Coinbase and PayPal. If you own an online shop, then check out which processors integrate with your shop.

- Shopify integrates with CoinPayments, BitPay, and Coinbase.

- Etsy works with any cryptocurrency, but it’s more of a manual process.

- WooCommerce integrates with 17 different payment processors via plugins.

With most payment processors, you have a few options.

- Client pays in crypto, we receive £

- Client pays in crypto, we receive crypto

The first option allows you to have the best of both worlds, you accept crypto and don’t get involved in any of the above issues. It makes sense and avoids most risk.

Our second option may prove to be an excellent investment if you can spare the money. If your suppliers accept crypto, then we are on to a winner.

Conclusion

Whatever option you choose there is a layer of management involved, eventually this will be minimal but with any new policy, we can expect a headache. We have 3 main options, accept crypto and receive crypto, accept crypto and receive £ or avoid completely.

Whatever you decide, the most important thing for any small business owner is peace of mind. Payments from clients allow you to live and continue doing what you love. Risk is fine, but crypto isn’t for everyone. Do what you feel is best for you and your business.

TweetStruggling with the above recipe? Hire a chef to do it for you